Contents:

You should carefully detail out all of the additional equipment that you will need to buy so that you can properly budget for that. I would definitely consider ease of use; both from the customer standpoint and the owner standpoint. Just know you will waste a ton of time and not have a clue where you are at from a profitability standpoint. Note that within each section, accounts typically skip ten digits. That’s so new, similar accounts can be inserted if needed.

Hiring Freeze: How it Works and its Impact – Investopedia

Hiring Freeze: How it Works and its Impact.

Posted: Fri, 03 Jun 2022 07:00:00 GMT [source]

It is also essential to keep a close eye on your inventory counts. Starting a businessor an owner looking to streamline your practices, accounting software can help you get the job done. Your chart of accounts is a living document for your business and because of that, accounts will inevitably need to be added or removed over time. The general rule for adding or removing accounts is to add accounts as they come in, but wait until the end of the year or quarter to remove any old accounts. As time goes by, you may find yourself wanting to create a new line item for each transaction. However, doing so could litter your company’s chart and make it confusing to navigate.

Restaurant Accounting Questions? Search This Site!

Once you download it, you can edit it to your heart’s content. You should also download our restaurant financial audit checklist and use the restaurant break even point calculator to stay even more on top of your finances. Here’s the skinny on restaurant charts of accounts and how you can make a useful one. It’s a big part of knowing how to manage restaurant accounts.

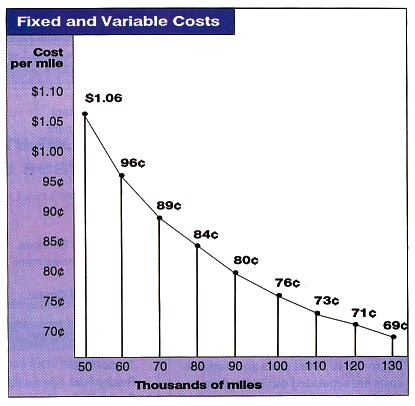

When self-driving trucks will take over – Business Insider

When self-driving trucks will take over.

Posted: Tue, 17 Jan 2017 08:00:00 GMT [source]

The initial investment and on-going monthly costs are significant and can quickly ratchet up to $50,000 – $100,000 or more depending what what you’re looking for. Your profit and loss statement, or P&L, is much like an income statement for the food truck. This document serves as a report to summarize income, expenses and inventory, illustrating your business’ total profits and losses over a specific period of time. It is best to prepare a P&L each week if at all possible. While useful in theory, it’s challenging to implement in reality.

You should ask your insurance agent for advice on what policies are right for your business. You will at least need auto insurance on the truck itself as well as a general liability policy. Don’t forget that if you are going to have employees you will also need workers compensation insurance. Lastly, as mentioned above, a good POS system is something you want to consider including in your startup expenses. Food truck operators often only look at the purchase of the truck as the startup expenses.

Why QuickBooks

These are your fixed occupancy and overhead expenses like rent, utilities, and insurance. The expense category is also home to labor cost and, optionally, prime cost. Restaurant equity accounts also include retained earnings. This is any net profit that’s not distributed as dividends to owners). Within the 1000s, you’ll list every asset account and specify whether they’re current or fixed.

Having a bird’s-eye-view of debt structure can help with strategic statement of stockholders equityment schedules that maximize cash flow and adhere to budgets. A good chart of accounts lets you see where your business’s money is coming from and going to. It also gives you a good idea of what you can liquidate if the going gets rough.

The Myth of the “Cheap” Food Business

Each line item represents an account within each category. Accounting systems, by definition, have a general ledger in which your asset accounts match your liability accounts . Working with a remote bookkeeping service will still provide you with all the value you could get from an in-office bookkeeper but at a fraction of the cost.

- A food truck balance sheet is a summary of your company’s assets, liabilities/obligations, and the owner’s financial involvement in the business.

- I’ve also talked with food truck owners that couldn’t pass their health inspection because their food truck didn’t have the correct fire suppression system installed.

- Your food truck balance sheet is a snapshot of your mobile food business’ financial position on any given day.

- Food trucks are advertised as a cheap way to start a business.

- This is a simple framework that will lead you down the path of generating the best chart of accounts for your business.

By focusing on the percentages rather than the whole numbers you will be focusing on profit. Systems like Clover say they integrate with QBO, but they do it in a manner that doesn’t work for the accounting end of things. Whether you are planning to pay yourself a W-2 salary or through an owner equity draw make sure you account for and budget your pay. I see owners change merchant processors all the time for tiny percentage savings. These tiny gains in merchant fees are often offset by hidden fees. Thecustomer is going to want something that is extremely easy to pay and tip on.

Knowing how to keep your company’s chart organized can make it easier for you to access financial information. Pay everything electronically via credit card or bank bill pay. This leaves a good paper trail and makes the accounting simple and automated. If your restaurant or bar inventory system integrates with your restaurant accounting , you can pull COGS at any time. That’s because BinWise lets you upload all supplier invoices right into your accounting platform. The cost of goods sold, or COGS, is the cost of acquiring and preparing items for sale.

Calculate your total monthly expenses in each category and then add all of the categories to calculate your overall monthly expenses. Subtract your expenses from your revenue to determine your net profit. If you are operating a food truck you are running a business and therefore you will have normal operating expenses just like every other business. I really encourage new food truck owners to get to know their business intimately from an expense standpoint right from the beginning. The more you understand where your money is going the better you will get at turning an acceptable profit.

For example, balance sheets are typically used for asset and liability accounts, while income statements are used for expense accounts. Each time you add or remove an account from your business, it’s important to record it into the correct account. Read on to learn how to create and utilize the chart to keep better track of your business’s accounts. If you don’t consistently create and consult a restaurant chart of accounts, it’s sad to say, but your chance of becoming a restaurant failure statistic skyrockets. You should use your chart of accounts to better understand your restaurant’s financial state and plan for its future. Come April, your restaurant chart of accounts will be your best friend.

But it’s ultimately reflected in a restaurant’s chart of accounts, which is a manager’s mise en place, immaculate refrigerator, and financial oracle. In this article, I outline the startup costs and ongoing expenses of operating a food truck business and provide a spreadsheet you can use to estimate the total cost to open. Food trucks are advertised as a cheap way to start a business. But if you’re planning to get into the food truck business solely for the reason of low startup cost think again.

Zachary has recommended Gusto to all his clients for years to handle their payroll needs. After the first review, the restaurant chart of accounts can be quite overwhelming, but don’t fret! Remember that the goal is to keep the income statement on one page so you can quickly review the financial performance of your business. We interview successful founders and share the stories behind their food trucks, restaurants, food and beverage brands. By sharing these stories, I want to help others get started.

A food truck should keep records of its sales revenue after each shift as well as totals for each day. Your food truck balance sheet is a snapshot of your mobile food business’ financial position on any given day. It is usually calculated at the end of the quarter or year. A food truck balance sheet is a summary of your company’s assets, liabilities/obligations, and the owner’s financial involvement in the business. It may make sense to create separate line items in your chart of accounts for different types of income. First, from not wanting to accept credit cards because they think it is saving them money.

“Lists all important financial information” may sound intimidating. This is a simple framework that will lead you down the path of generating the best chart of accounts for your business. Let’s be real; at the end of the day, the chart of accounts in QuickBooks is here to serve you. This article will give you a complete restaurant chart of accounts and a quick overview to help you understand the basics of your chart of accounts. In-depth breakdown and analysis of the expenses of operating a food truck. Eric Silverstein is the owner of The Peached Tortilla, an award winning food truck in Austin, Texas.

Essentially, you want to strive for more income than expenses. When you are able to bring in more money than you spend, you are maximizing your net income, and overall your profits will grow. We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites. Within each category, line items will distinguish the specific accounts.

- It gives you great insight into the restaurant KPI that drive your profits.

- Just know you will waste a ton of time and not have a clue where you are at from a profitability standpoint.

- You should carefully detail out all of the additional equipment that you will need to buy so that you can properly budget for that.

- This leaves a good paper trail and makes the accounting simple and automated.

- It’ll have all the expenses and revenues you need to copy over to your IRS forms.

Fully-integrated systems like these can take the burden off you and help you fully analyze your financials by running comprehensive reports. This is the default chart of accounts we use for Simple Restaurant Accounting. It includes all the accounts we believe the average restaurant will need, and combines some common accounts that are rarely used by smaller businesses. This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Intuit Inc. does not have any responsibility for updating or revising any information presented herein.